Sources:

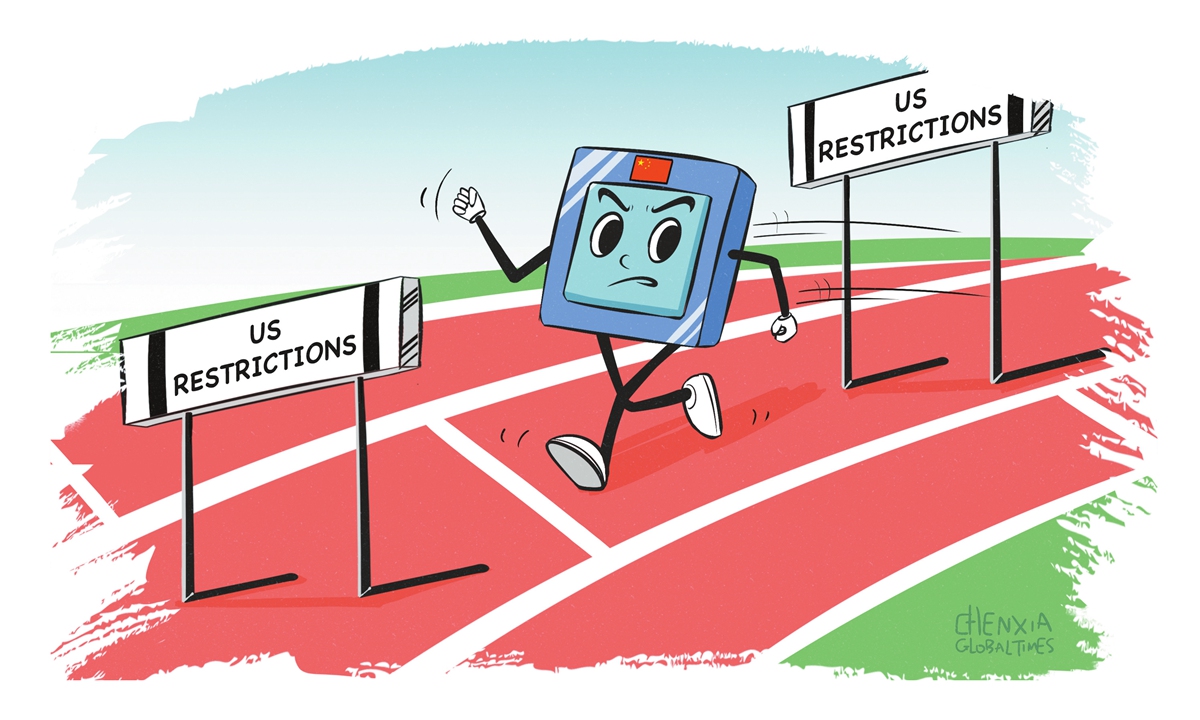

Nvidia is set to launch a new Blackwell-based chip tailored for the Chinese market in June, priced at approximately half the cost of its previous H20 model. This strategic move comes amid ongoing U.S. export restrictions that have limited Nvidia's ability to sell its most advanced chips in China since 2022.

The U.S. government's ban on H20 sales to China has caused Nvidia to lose an estimated $15 billion in sales, with analysts revising fiscal year 2026 sales expectations to $10-$12 billion. Despite these challenges, Nvidia CEO Jensen Huang views China as a

$50 billion opportunity, though market share has dropped to 50 percent due to restrictions.

"China is a $50 billion opportunity for Nvidia, yet US restrictions have held them back to the point where Nvidia's CEO has revealed that they could be replaced," highlighting the competitive pressure Nvidia faces.

The launch of the Blackwell-based chip at half the H20 price aims to regain market share and adapt to the complex U.S.-China technological competition, which has evolved into a dynamic struggle beyond simple containment.

Meanwhile, China has bolstered its semiconductor industry through increased funding and supportive policies to promote domestic alternatives, intensifying the competitive landscape.

Despite near-term challenges, Nvidia maintains strong financial health, with a 75% gross profit margin and a bullish outlook from BofA Securities, which continues to rate Nvidia as a Buy with a $160 price target.

This development underscores Nvidia's strategic positioning in the global AI deployment cycle and its efforts to navigate geopolitical constraints while capitalizing on the lucrative Chinese market.

Sources:

Nvidia plans to launch a Blackwell-based chip for China in June, priced at about half the cost of its H20 model, amid U.S. export restrictions. The move aims to regain market share in China, a $50 billion opportunity, despite ongoing geopolitical and supply chain challenges.