Sources:

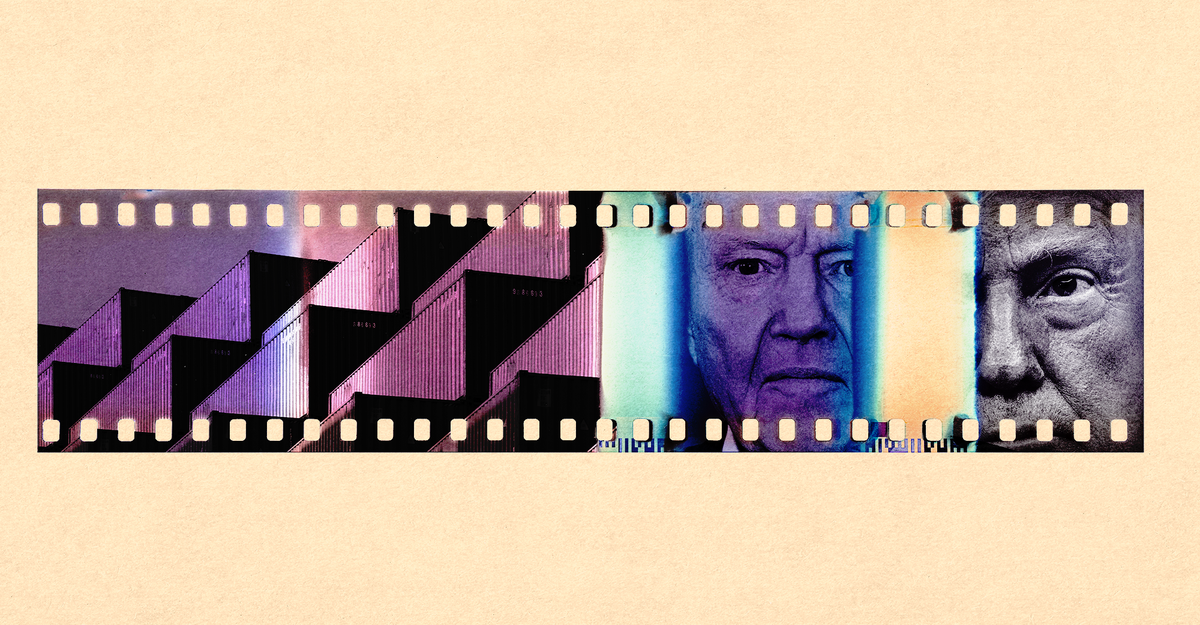

California's film industry is in crisis, with production levels still struggling to recover from the COVID-19 pandemic and the recent writers' and actors' strikes. Governor Gavin Newsom's proposed

$7.5 billion federal tax credit aims to address these challenges by significantly expanding the state's existing tax credit program.

According to FilmLA, which issues film permits,

production has not rebounded as expected, prompting calls for better incentives to retain business in California.

Casey Bloys, chairman and CEO of HBO and Max Content, emphasized that the current tax credit program is in dire need of updates.

In response to the industry's plight, Newsom's proposal seeks to more than double California's tax credit offerings, with two bills currently in the state legislature aimed at broadening the types of productions eligible for credits. The

Screen Actors Guild (SAG-AFTRA) has expressed support for efforts to boost production in the U.S., highlighting the importance of revitalizing the film and television sectors.

As the industry faces increasing competition and challenges, Newsom's ambitious plan could provide the necessary support to revive California's status as a leading hub for film and television production.

Sources:

California Governor Gavin Newsom has proposed a $7.5 billion federal tax credit aimed at revitalizing the struggling film industry, which has faced significant production declines due to the COVID-19 pandemic and recent strikes. The initiative seeks to enhance existing state tax incentives for film and television production.